Publication: The Daily Star. Date: January 05, 2017, By: Md Fazlur Rahman

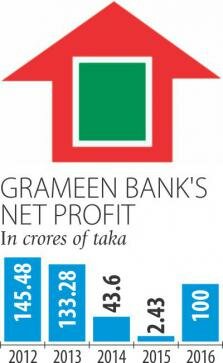

Grameen Bank’s net profit rebounded in 2016, with the microcredit pioneer logging in Tk 100 crore on the back of increased loan disbursement and recovery.

Grameen Bank’s net profit rebounded in 2016, with the microcredit pioneer logging in Tk 100 crore on the back of increased loan disbursement and recovery.

A stable economic environment and the absence of any major natural disaster helped the bank raise the profits from only Tk 2.43 crore in 2015.

Its net profit came down sharply in 2015 following the implementation of the national pay-scale for its 21,000 employees with retrospective effect. The lender had to spend Tk 450 crore on the additional salary expenses.

However, officials said the new pay-scale encouraged the employees to put in more efforts in lending and recovering loans.

The bank disbursed Tk 18,754 crore last year. Its outstanding loans stood at Tk 11,824 crore in 2016 which was Tk 9,642 crore a year ago. Last year, the bank also recovered Tk 105 crore in bad loans.

The bank saw lower-than-expected profits in 2014 and 2015. In 2014, it made a profit of Tk 43 crore.

Bankers said the bank’s activities slowed in 2013 and 2014 because of various uncertainties that affected its profit margin.

Ratan Kumar Nag, acting managing director of the bank, said the lender strengthened its activities in late 2015 which continued in 2016.

He said loan portfolio, number of members, outstanding loans and net profit — all went up in 2016 compared to 2015.

The bank has been distributing dividends among its shareholders since 2006. Before that, it could not pay dividends as the amount of profit was low and the central bank instructed Grameen Bank to keep the profit in its disaster fund.

However, since 2008 the microcredit lender has been giving out 30 percent annual dividends.

The government received Tk 5.83 crore in dividends in 2015 thanks to its 25 percent stake in the bank. The bank’s 62 lakh shareholders received the rest of the dividends.

Last year, Grameen Bank, founded by Nobel laureate Prof Muhammad Yunus, added more than one lakh members to take the total number to 89 lakh.

Although the bank has been performing well financially, other issues are hampering its activities.

The borrowers who own 75 percent share in the bank do not have representation in the board as the tenure of the nine elected directors ended in February last year. Since then the election to pick the directors from the borrowers has not been held.

Another issue is: the bank has been running by an acting managing director since Prof Yunus left it in 2011.

The issue is pending in the court after the nine elected directors went to the court challenging the Grameen Bank board’s authority to publish newspaper advertisement to appoint the chief executive.

On Sunday, Finance Minister AMA Muhith said the government would move to get the case resolved.

On an average, Grameen Bank lends Tk 1,500 crore per month. It has 2,566 branches across the country. Its non-performing loans stand at less than 2 percent.

Since its inception in 1983, the bank has distributed Tk 123,000 crore in loans.