Grameen Bank is on course for record profit in what can be described as a pat on the back to the stewardship of the three government-appointed directors and the acting managing director.

Grameen Bank is on course for record profit in what can be described as a pat on the back to the stewardship of the three government-appointed directors and the acting managing director.

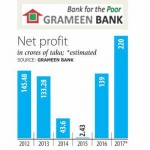

The Nobel Prize-winning organisation recorded Tk 310 crore as operating profit , up 16.54 percent year-on-year, according to Ratan Kumar Nag, acting managing director of the bank.

“This is the highest operating profit achieved by Grameen Bank,” said Nag, who has been serving as the acting MD since October.

The record operating profit, which came on the back of increased loan disbursement, recovery and beefed-up monitoring by the head office, paved the way for the microlender to log in its highest net profit in its 35-year history.

The bank may post a net profit of about Tk 220 crore , which would be an increase of 58 percent from a year earlier.

The net profit figure will become available next month after deducting all expenses. The previous highest net profit was recorded — Tk 145.48 crore.

The sharp rise in both operating profit and net profit came despite fully implementing the salary for its 21,000 employees in line with the government’s salary for the public sector.

Grameen Bank officials said the new pay-scale encouraged the employees to put in more efforts in lending and recovering loans.

The head office undertook month-based activities and follow-up programmes from the very first month of the year and it continued , said the officials.

The acting managing director himself visited zonal offices and maintained regular contacts with managers at branch, area and zone levels to give a boost to the bank’s activities and targets.

Senior officials were also sent to field offices for visits. As a result, the employees were motivated.

Nag even talked to senior managers over Skype several times during the course of the year, said another banker.

The bank has been distributing dividends among its shareholders .

Before that, it could not pay dividends as the amount of profit was low and the central bank instructed Grameen Bank to keep the profit in its disaster fund.

However, the microcredit lender has been giving out 30 percent annual dividends to its 62 lakh shareholders.

In December last year, the government received Tk 6.17 crore in dividend thanks to its 25 percent stake in the bank.

The government received a total of Tk 25.23 crore in dividends against its total investment of Tk 20.58 crore in the bank in the last three decades.

The borrower-shareholders received Tk 185.15 crore in dividends against their combined investment of Tk 64.20 crore.

Grameen Bank’s net profit came down sharply following the implementation of the national pay-scale for its employees retrospectively. The lender had to spend Tk 450 crore on the additional salary expenses.

Last year, Grameen Bank, founded by Nobel laureate Muhammad Yunus, added about 10 lakh new members to take the total past 90 lakh.

The bank disbursed Tk 24,000 crore last year, up 28 percent from Tk 18,754 crore . Its outstanding loans rose Tk 2,600 crore in the year to stand at Tk 14,000 crore at the end of the year.

Last year, the bank, which has 99 percent loan recovery record, also recovered Tk 115 crore in bad loans.

The bad loan recovery was also the highest, and came on the back of year-long activities and monitoring of the bank.

In a statement, the bank said 26 zones in which the bank operates were hit by floods earlier last year.

As a result, the bank had stopped collecting instalments in those areas and stood by the victims with relief and rehabilitation efforts such that the affected members can stand on their own feet at the earliest.

The bank has not resumed instalment collection in Sunamganj and Netrokona, the two most flood-affected areas, yet.

“The momentum will continue ,” Nag added.

Source: The Daily Star

Grameen Bank is on course for record profit in what can be described as a pat on the back to the stewardship of the three government-appointed directors and the acting managing director.

Grameen Bank is on course for record profit in what can be described as a pat on the back to the stewardship of the three government-appointed directors and the acting managing director.

বন্যার শুরুতেই এই দুর্যোগ মোকাবেলার উদ্দেশ্যে ব্যাংকের এমডি রতন কুমার নাগের নির্দেশনায় প্রধান কার্যালয়ে কেন্দ্রীয়ভাবে গ্রামীণ ব্যাংকের একটি ‘বন্যা দুর্যোগ মোকাবেলা কমিটি’ গঠন করা হয়। এই কমিটি বন্যাদুর্গত জোনগুলোর সঙ্গে সার্বক্ষণিক যোগাযোগ রক্ষা করে বন্যা পরিস্থিতির নিয়মিত মনিটরিং করে। তারা বন্যাদুর্গত সদস্যদের দুর্যোগ মোকাবেলায় প্রয়োজনীয় পরামর্শ ও সার্বিক সহযোগিতা প্রদান করে। এ ছাড়া প্রয়োজনীয় যোগাযোগ করে বন্যার তথ্য সংগ্রহ, কর্তৃপক্ষকে অবহিতকরণ ও প্রজেকশনের উদ্দেশ্যে প্রধান কার্যালয়ে একটি ‘বন্যাসংক্রান্ত তথ্য কমিটি’ গঠন করা হয়। প্রাথমিক তথ্য অনুযায়ী ব্যাংকের ২৬টি জোনের অন্তর্ভুক্ত ১৫৫ এরিয়ার ৬২৮টি শাখার ছয় লক্ষাধিক সদস্য-পরিবার এ বন্যায় সরাসরি ক্ষতিগ্রস্ত হয়েছে। ব্যাংকের সহকর্মীরা বন্যাকালীন প্রত্যেক বন্যার্ত সদস্যের সঙ্গে নিয়মিত যোগাযোগ করে তাদের পাশে থেকে দুর্যোগ মোকাবেলায় তাদের সহযোগিতা প্রদান করেন।

বন্যার শুরুতেই এই দুর্যোগ মোকাবেলার উদ্দেশ্যে ব্যাংকের এমডি রতন কুমার নাগের নির্দেশনায় প্রধান কার্যালয়ে কেন্দ্রীয়ভাবে গ্রামীণ ব্যাংকের একটি ‘বন্যা দুর্যোগ মোকাবেলা কমিটি’ গঠন করা হয়। এই কমিটি বন্যাদুর্গত জোনগুলোর সঙ্গে সার্বক্ষণিক যোগাযোগ রক্ষা করে বন্যা পরিস্থিতির নিয়মিত মনিটরিং করে। তারা বন্যাদুর্গত সদস্যদের দুর্যোগ মোকাবেলায় প্রয়োজনীয় পরামর্শ ও সার্বিক সহযোগিতা প্রদান করে। এ ছাড়া প্রয়োজনীয় যোগাযোগ করে বন্যার তথ্য সংগ্রহ, কর্তৃপক্ষকে অবহিতকরণ ও প্রজেকশনের উদ্দেশ্যে প্রধান কার্যালয়ে একটি ‘বন্যাসংক্রান্ত তথ্য কমিটি’ গঠন করা হয়। প্রাথমিক তথ্য অনুযায়ী ব্যাংকের ২৬টি জোনের অন্তর্ভুক্ত ১৫৫ এরিয়ার ৬২৮টি শাখার ছয় লক্ষাধিক সদস্য-পরিবার এ বন্যায় সরাসরি ক্ষতিগ্রস্ত হয়েছে। ব্যাংকের সহকর্মীরা বন্যাকালীন প্রত্যেক বন্যার্ত সদস্যের সঙ্গে নিয়মিত যোগাযোগ করে তাদের পাশে থেকে দুর্যোগ মোকাবেলায় তাদের সহযোগিতা প্রদান করেন।